Automated workflows to build your business machine. Delivered every Tuesday.

There’s a specific kind of physical pain that hits when you’re writing a quarterly estimated tax check.

It’s not just the number. It’s the uncertainty. You’re essentially pre-paying for income you haven’t earned yet, based on math you don’t trust, hoping you’re “close enough” to avoid penalties but not so generous that you’re giving the IRS an interest-free loan.

So you do one of two things:

The Ostrich. You ignore it entirely. You tell yourself you’ll “catch up later.” And then April rolls around and you’re hit with penalties that feel like punishment for the crime of... trying to run a business.

The Security Blanket. You overpay—massively—just to sleep at night. Better safe than sorry, right?

Both reactions are irrational. But they’re not your fault.

Because the real villain here isn’t procrastination or paranoia. It’s Linear Projection.

Here’s how it destroys you: You have a great January. Maybe you land a $20k contract. You plug that into QuickBooks or some online calculator, and it does what every dumb tool does—it multiplies your best month by 12.

Boom. It tells you you’re on track to make $240k this year and demands a $15k payment right now.

But you’re not going to make $240k. You might make $80k. Or $120k. Or who knows—because you’re a solopreneur and revenue is lumpy.

So you send the IRS $15k in February based on a fantasy projection, and then you spend the rest of the year cash-poor because you front-loaded your tax bill nine months too early.

There’s a better way.

The IRS has a rule—a good rule, for once—that lets you pay based on what you earned last year, not what some algorithm thinks you’ll earn this year.

It’s called the Safe Harbor Rule. And if you use it correctly, you can legally defer thousands of dollars in taxes while staying 100% penalty-free.

It’s not a loophole. It’s not sketchy. It’s just math that actually works in your favor.

But here’s the thing—most people don’t know the number. And the tools that are supposed to help you calculate it? They’re either too conservative (because they’re terrified of liability) or they hallucinate (because they’re just LLMs guessing at tax law).

So we built something that doesn’t guess.

Let me show you how this actually works.

The Data: Penalty vs. Shield

Before I introduce the tool, I want Sage to explain the actual mechanics here—because the IRS doesn't mess around, and you need to understand both the penalty and the shield.

Sage—what’s the real cost of underpaying, and how does Safe Harbor actually protect you?

Sage: Analysis

The Penalty Structure: The IRS assesses an underpayment penalty at approximately 8% per year (compounded daily) on any quarterly shortfall.

The Safe Harbor Rule (IRC §6654): To avoid the penalty, you must pay the lesser of:

1. 90% of Current Year Tax (The "Guess").

2. 100% of Prior Year Tax (The "Shield"). (Note: If your prior year AGI was >$150k, you must pay 110% of prior year tax).

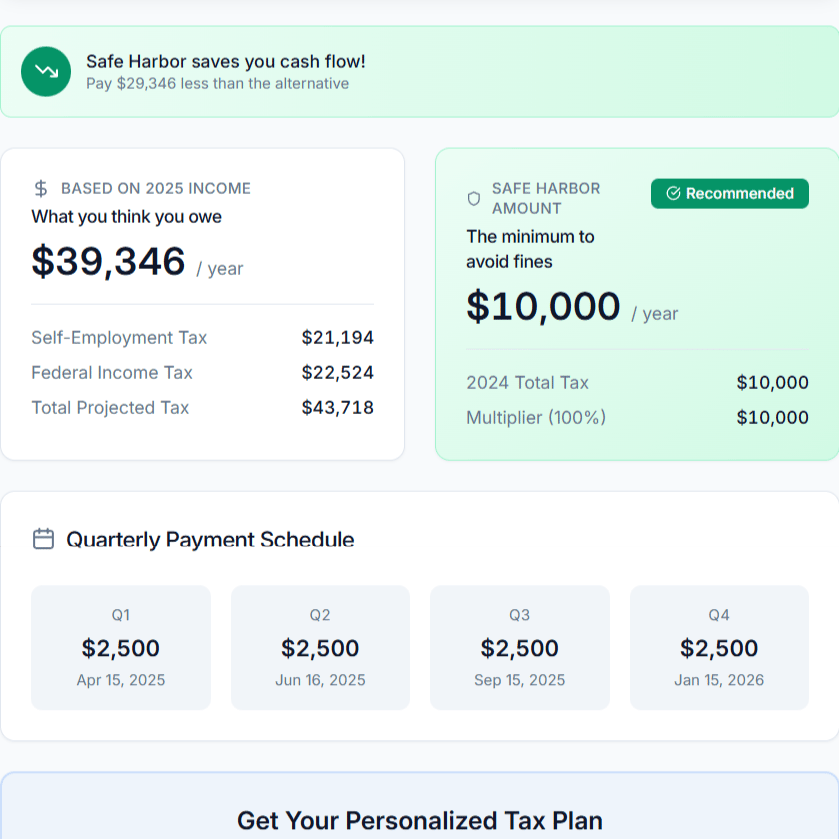

The Deferral Math (Standard Example):

* Prior Year Tax (2024): $10,000.

* Current Year Projected Tax (2025): $50,000.

* Linear Projection Payment: ~$12,500/quarter (Based on the $50k guess).

* Safe Harbor Payment: $2,500/quarter (Based on the $10k reality).

The Win: You legally keep $10,000 per quarter in your own bank account until April 2026. That is a 0% interest loan from the government.

Okay. So the penalty is real—8% is higher than most business loans. But the shield is also real. If you paid $10k in tax last year, you only need to pay $2,500/quarter this year to be completely safe. Even if you end up owing $50k in April 2026.

That’s not a guess. That’s IRS code.

The "Cash Poor" Spiral

Let me tell you the story that made me realize how broken this system is.

I watched a creator—someone I’d been advising casually—land a solid retainer in January 2024. $12k. It was the best month she'd ever had.

Two weeks later, she called me in a panic. Her accountant had told her she needed to send the IRS $9,000 by January 15th.

Why? Because the accountant plugged that $12k into a linear projection model, assumed she’d make $144k for the year, and calculated her quarterly payment based on that fantasy.

She didn’t have $9k liquid. So she put it on a credit card at 22% APR.

By March, the retainer ended. She made $3k that month. Then $2k in April. By the end of the year, she had made roughly $60k—not $144k.

Here is the tragedy: Her tax liability for the previous year was low—she only owed about $7,200 total ($1,800/quarter).

The Math of the Mistake:

She Paid: $9,000 (The Panic Number).

She Could Have Paid: $1,800 (The Safe Harbor Number).

The Cost: She overpaid by $7,200 in a single quarter.

She paid interest on a credit card to give the IRS an interest-free loan they didn't even ask for.

This is the Linear Projection Trap.

QuickBooks does it. TurboTax does it. Every generic estimated tax calculator does it. Because they’re optimizing for one thing: not getting sued. They don’t care about your cash flow. They care about making sure you never underpay.

But here’s the thing—underpaying isn’t the crime. Underpaying below the Safe Harbor threshold is the crime.

And that threshold is way, way lower than what those tools tell you to pay.

So what’s the alternative?

You calculate your actual Safe Harbor number. You pay that. You keep your cash working for you (in a high-yield savings account, in your business, wherever). And you “True-Up” in April when you actually know what you owe.

That’s not reckless. That’s just smart capital allocation.

The Fix: The Safe Harbor Tax Shield

Here’s the problem: ChatGPT can’t do this math reliably. I tested it. It struggles with context blindness—it often doesn't know to apply the "Lesser Of" logic unless you prompt it with perfect legal specificity.

And QuickBooks? Still using linear projection.

So we built The Safe Harbor Tax Shield.

It’s not an AI wrapper. It’s deterministic logic—the actual IRS formulas, hardcoded, with zero room for hallucination. You plug in three numbers:

Your 2024 total tax liability (from your return).

Your 2024 AGI (to check the high earner rule).

Your expected 2025 income (optional—for comparison only).

And it spits out two numbers:

Your Safe Harbor Minimum (the lowest amount you can pay per quarter without penalty).

Your Estimated True-Up (what you’ll owe in April 2026 if your projection is accurate).

Screenshot of the Safe Harbor Tax Shield

That second number is critical. Because the Shield protects your cash flow today, but it doesn’t erase your tax bill. It just defers it.

Which means—if you want to lower that True-Up number—you need to be tracking expenses aggressively between now and April.

Every mile. Every software subscription. Every home office deduction. Every meal with a client. That’s what turns a $40k True-Up into a $25k True-Up.

And if you’re not using real accounting software to track that stuff automatically, you’re leaving money on the table.

That’s where FreshBooks comes in. We use it. It syncs with your bank, auto-categorizes expenses, and makes sure you’re not scrambling in March trying to remember what you spent in June.

The Shield protects your cash flow today. FreshBooks protects your bank account next April.

Stop guessing. Calculate your Shield.

And if you want to make sure you're capturing every write-off between now and April 2026:

— Scott

Ready to Reclaim Your Time?

Don’t just scale. Build a machine. Join other Ambitious Solopreneurs and get our next automated workflow delivered straight to your inbox.