Automated workflows to build your business machine. Delivered every Tuesday.

You know what's wild?

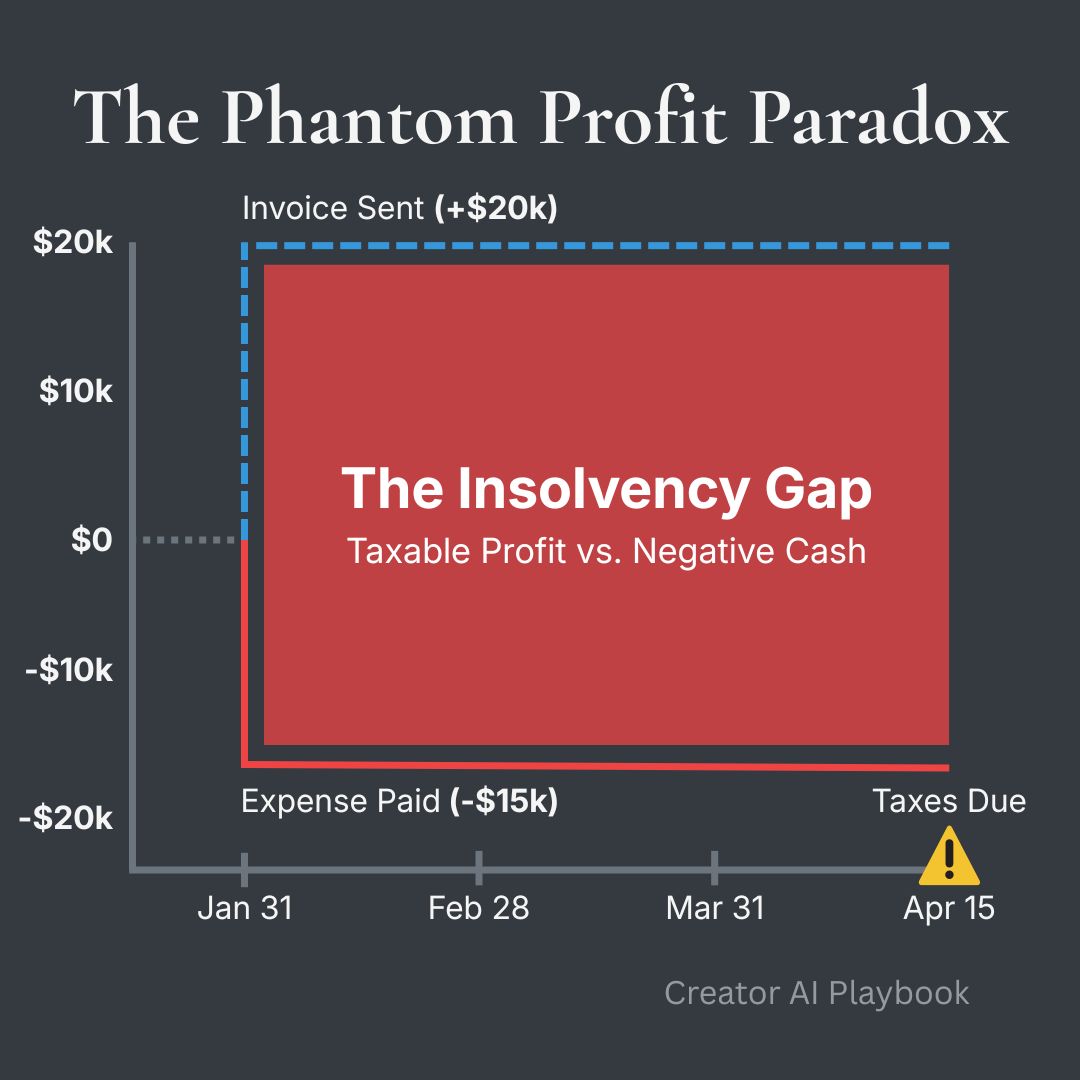

You can be profitable and broke at the same time. Not "poor cash flow management" broke. Not "overspending" broke. I mean literally—mathematically—insolvent while your P&L says you're killing it.

Here's the trap:

You invoice a client for $20,000. You incur $15,000 in expenses to deliver the work. Your accounting software congratulates you on your $5,000 profit.

Meanwhile, your bank account is -$15,000 in the hole.

Because that invoice? It's not cash. It's a promise. And promises don't pay your rent.

This is the Phantom Profit Paradox—and if you're using Accrual Accounting (which most software defaults to), you're living inside a hallucination.

The one-liner: Profit is a theory. Solvency is a fact. You can go bankrupt while being profitable.

Let me show you the math. I asked Sage, my AI analyst, to run the forensics on this exact scenario:

Sage:

Forensic Analysis: The Insolvency Gap

Scenario: A solopreneur invoices $20,000 on January 15th with Net 30 terms. They incur $15,000 in expenses on the same day.

Accrual Accounting View (What Your Software Shows):

* Revenue (Invoiced): +$20,000

* Expenses (Incurred): -$15,000

* Net Profit: $5,000

Cash Accounting View (What Your Bank Shows):

* Cash In: $0 (Invoice unpaid for 30-45 days)

* Cash Out: -$15,000

* Actual Bank Balance: -$15,000

The Tax Trap: The IRS requires estimated quarterly tax payments based on accrual income. If that $20,000 invoice remains unpaid by the April 15th estimated tax deadline, the entrepreneur must pay taxes on $5,000 of "profit" they do not possess. This effectively forces a loan—either from personal credit or savings—to satisfy a tax obligation on unrealized income.

Systemic Context:

* 50% of U.S. small businesses are currently owed outstanding payments (Intuit Small Business Index).

* Average DSO (Days Sales Outstanding) for small businesses: 45-60 days.

* Minority entrepreneurs face higher barriers to traditional bank loans, forcing reliance on credit cards (avg. APR: 24%+) to bridge cash gaps.

Conclusion: Accrual accounting creates a structural disconnect between reported profitability and actual solvency. The entrepreneur is simultaneously "profitable" on paper and insolvent in reality.

The Napkin Test: How to Calculate Yours

You don't need fancy software to see if you are in the Danger Zone. You just need to look at your Open Invoices.

Do this simple math right now:

Total Unpaid Invoices: Sum up every invoice you have sent that hasn't been paid yet. (e.g., $15,000).

Current Cash Balance: Look at your actual bank balance today. (e.g., $4,000).

The Burn Calculation: If you received $0 from those invoices for the next 45 days, would your Current Cash Balance cover your expenses?

If the answer is No, you are in the Insolvency Gap. You are technically bankrupt, waiting for a savior check to clear.

The Builder's Blindspot

Here is the curse of being a Builder at heart.

We obsess over the product. We agonize over the user experience, the color palette, the code structure. We want the thing to exist and be beautiful.

But because we focus on the product, we tend to ignore the physics of money.

Most of us treat a $1 invoice exactly the same as $1 of cash in our mental model. We view them as fungible—interchangeable points on a scoreboard.

They are not.

An invoice is a receivable. It's an IOU. It's a bet that someone will pay you—eventually. Cash is oxygen. It's the only thing that actually keeps the lights on.

And here is the realization that changes everything: "Net 30" isn't a business term. It's a borrowing term.

When you send an invoice with Net 30 terms, you are acting as a 0% interest bank for your client. You delivered the work. You incurred the expenses. You are financing their project. Meanwhile, if a payment slips by two days and you need to cover expenses, you're potentially pulling out a credit card at 20%+ APR.

You're giving free loans while taking expensive ones. The math doesn't work.

We need to stop looking at "Revenue" and start looking at Cash Velocity. If the money isn't in the bank, it doesn't exist.

That's the shift.

The Cash Velocity Engine

(Status: Deploying to Udaller One next week)

To fix this, we need to install a new logic layer into your operating system—one that tracks the reality of your cash position, not the fantasy.

In the Udaller OS, we call this The Cash Velocity Engine.

Here is the logic it uses to protect your solvency:

1. DSO Tracking (Days Sales Outstanding) We measure exactly how long it takes to get paid. Not "Net 30." Not what the contract says. The actual time from invoice sent to cash received.

2. Cash Zero Date (Runway Alert) We calculate the exact date you will run out of cash—regardless of how many invoices are "pending." This is your true solvency metric.

No more guessing. No more surprises. You'll know—to the day—when the runway ends.

Your Immediate Action

Stop using the "Profit & Loss" view in your accounting software.

Switch to the Cash Flow view.

If your software makes that hard, you're using the wrong software. Profit is vanity. Cash is sanity.

This is why we built Udaller One: to do the math that standard accounting tools ignore.

Start by running the True Rate Calculator to see what your margins actually look like when you account for unpaid invoices and time-to-payment.

Don't just scale. Build a machine.

— Scott Founder, Udaller

Ready to Reclaim Your Time?

Don’t just scale. Build a machine. Join other Ambitious Solopreneurs and get our next automated workflow delivered straight to your inbox.